APRA has started tightening home loan rules, and there’s more to come!

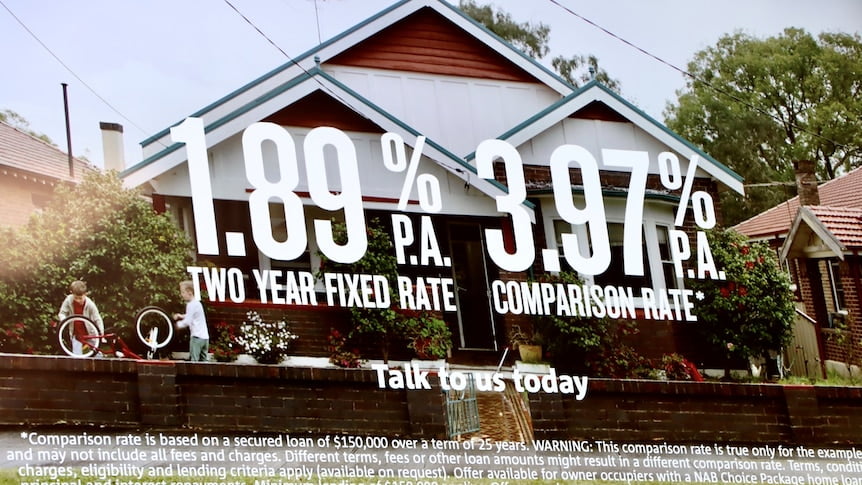

The combination of low-interest rates and soaring house prices (30% in one year) has made Australia’s housing market an incredibly attractive investment opportunity.

However, recent changes to Australia’s home loan rules and banks increasing fixed-rate home loans mean that it’s already harder to enter the market than it was just a few months ago, making it more important than ever to understand how these new rules can affect your property investing.

Here’s what you need to know about these new regulations.

Over the past two weeks, APRA has required banks to assess how a prospective borrower would cope with a three percentage point increase in mortgage interest rates. Up from the previous stress test at 2.5%

For example, a bank offering interest rates at 2.69% would need to see how a borrower would cope with their mortgage rate rising by 3 percentage points to 5.69%.

And it seems this is just the beginning!

Wayne Byres, the chairman of the Australian Prudential Regulation Authority (APRA), has hinted there were even stricter rules the banking regulator ‘could deploy in the future’ as national property prices soar at the fastest annual pace since 1989, CoreLogic data showed.

So what does this mean for you and your property investing future?

When APRA made similar changes a few years ago, thousands of people were unable to access finance.

We suggest that the best time to purchase your investment property is now before APRA regulates even tougher restrictions; noting that property is a long term investment.

DDP Property has got your back.

Whether you’re a first-time buyer or a seasoned investor looking to expand your portfolio, our finance experts can find a loan that works for you and our buyer’s agents will show you the best investment properties available from our exclusive network.

Interested to make a move before it gets even harder?