50% of our clients at DDP buy investment properties

using their superannuation.

Savvy investors are opting to take control of their financial future by leveraging their super balance to acquire a more valuable secured asset. Could you be eligible?

Here’s what you need to know:

- You only need to access/spend the deposit amount, and you may seek a loan for the remainder. Many lenders offer 80% funding with a 20% deposit from your super fund.

- You can purchase a property with around $120,000 in super for approximately a $400,000 purchase price.

- There are pretty great tax benefits to buying property in super.

- The properties sourced via DDP for our super clients are great locations Australia wide with high growth and rental yields

- You can combine your super with family to purchase the property together.

This is a long-term investment, so it’s not a matter of when to buy.

It’s a matter of WHERE to buy.

When you elect to invest your super in property with DDP, we’ll not only manage the process from start to finish, but we’ll also identify high-growth suburbs and investment opportunities.

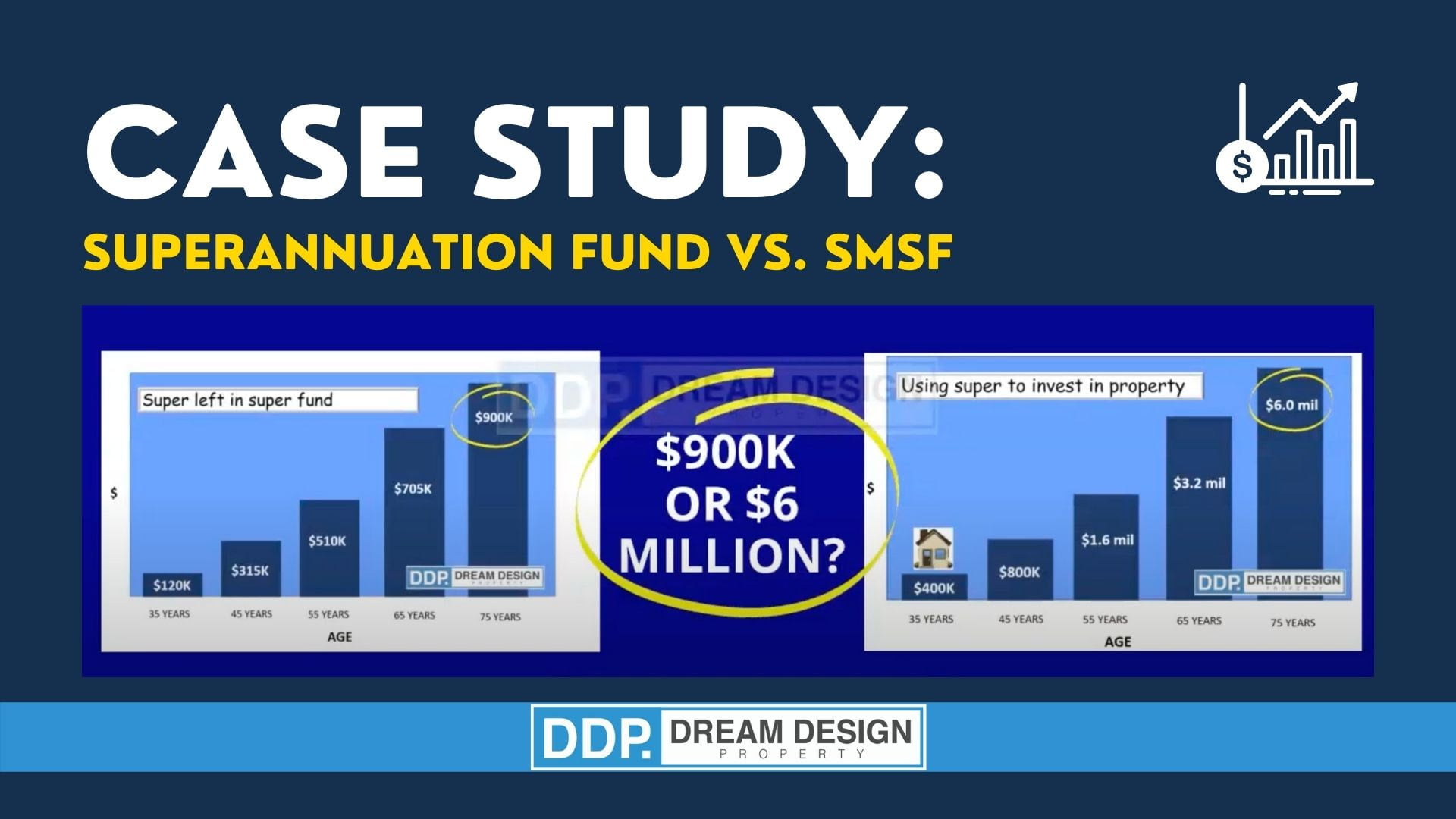

This case study illustrates the power of financial leverage.

The average super balance, much like the Australian real estate market, appreciates at 5-7% historically.

If at age 35 you have $120k in super, 40 years later you’ll be looking at a superannuation balance of $900k.

Now, if you saw a capital growth rate of 7%, having purchased a property at $400k at age 35, you would be looking at a valuation between $3.2-6M over the same period.

How is this possible?

Banks consider property to be an extremely secure asset, meaning that you you can borrow 80% of money against it.

Then over time, you can pay off the loan with rental income, the appreciation of the property, and enjoy significant tax benefits.

With so many of our clients using their SMSF to build their wealth, we can show you exactly what you need to do to get involved before it’s too late. If you’re ready to set yourself up for that comfortable retirement you’ve always wanted, get in touch with DDP.

Contact us today to book your personalised appointment and get your super working for you.