Most Australians would have lost about 15% of their Super balance in recent months.

BELOW, we show you how to recover your losses, AND ALSO recover your wealth so you have a super balance higher than what it was prior to COVID-19 and for the long term.

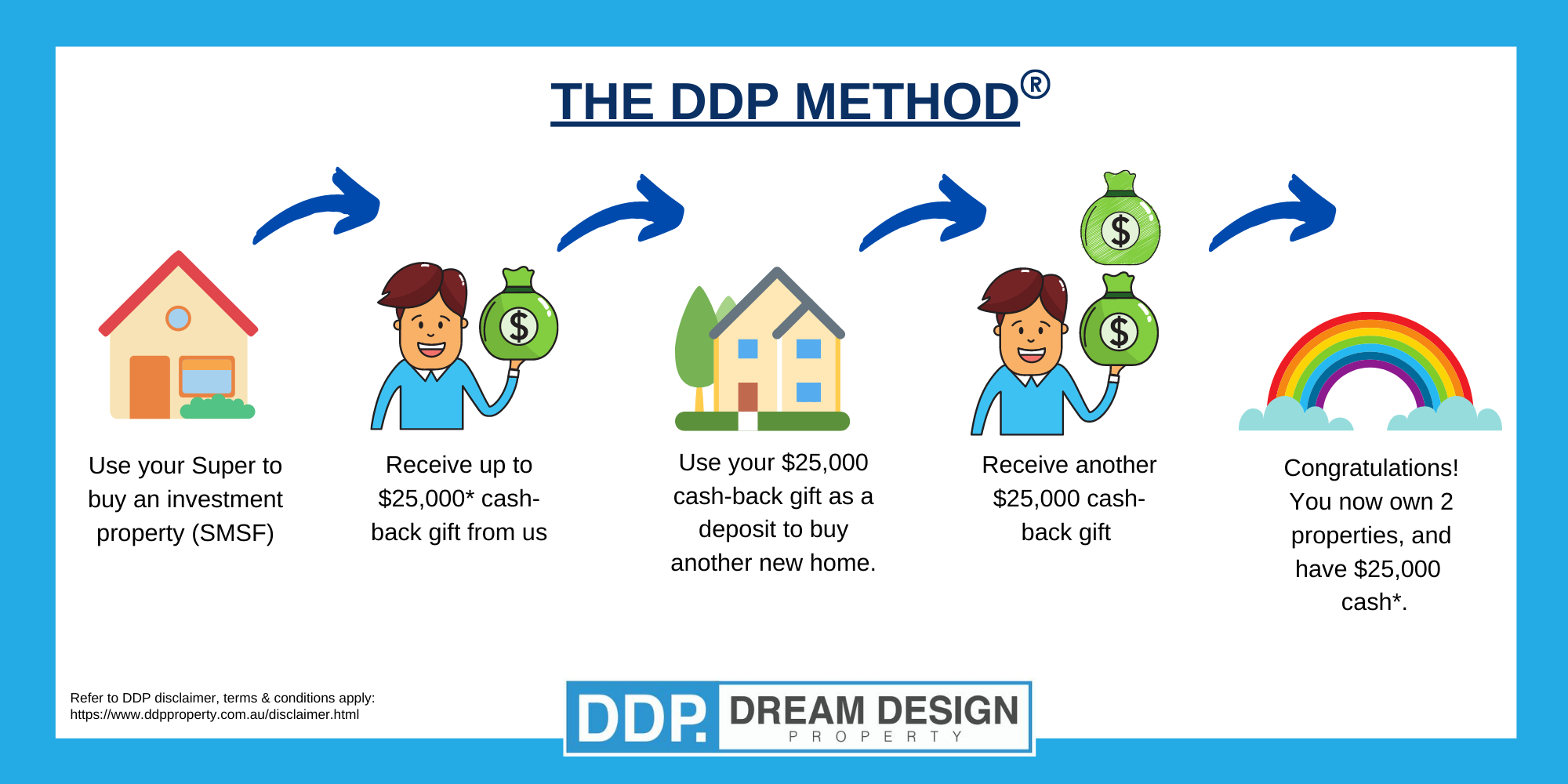

4 STEPS TO SUCCESS:

1. Create wealth using leveraged assets

Super is invested in unleveraged asset classes (with the majority being spread across shares, cash, bonds, property and other fixed interest investments). Based on this approach, growth on your super balance will average 6% per year in the long run.

If however you had invested your Super into a SMSF (Self-Managed Super Fund – i.e. used your super balance to buy an investment property); you could have borrowed money from the bank to fund your investment. This is what we refer to as a leveraged asset.

Let’s assume the purchase price of your property is $400K:

In 10 years, (based on past performance) your property will be valued at approximately $750K, meaning your capital growth would be a $35,000 gain every year over 10 years. Thus in only 1 year, you may have not only regained any losses from the COVID plunge, you may have made a far greater gain than if you had continued to leave your money in your super fund for another year.

2. Receive $25,000 cash-back when you buy a new property in Super.

Our Clients receive a gift of up to $25,000 paid into their bank accounts when they buy a NEW property through us. (Essentially, our Clients invest ZERO dollars from their person finances/savings and are rewarded with a bonus $25,000 cash gift payment.)

Your decision to set up an SMSF has instantly outweighed any losses that resulted from the COVID_19 plummet.

3. Use your gift cash-back to purchase an additional property and enjoy the fruits of capital growth across 2 properties.

Many of our Clients use their cash-backs as deposits for another property.

The news keeps getting better! Once you buy a 2nd new property, you receive ANOTHER cash-back of $25,000*.

4. Set your investments up, then sit back and relax. You have now successfully joined the 1% club.

As with all property investments, the approach should always be for the long term; we recommend holding for a minimum of 10 years (this period of time allows to ride and off-set any economic downturns – we know the medium house price across major capital cities has grown steadily over the last 40 years despite economic crises, and property prices continue to close to double in value every 10 or so years on the eastern side of Australia*).

We have completed this strategy for hundreds of our SMSF Clients with our partner Financial Advisers and Accountants who will review your situation and guide you if SMSF is the correct investment path for you.