Recently we have seen a growing interest in the media on the topic of superannuation.* It’s no wonder, last year the stock market crashed 36% directly affecting Australian superfunds.

Australia’s largest super fund, Australian Super, has told its members to expect to “lose money 5 years out of 20”.*

Consequently, for the first time millions of Australians are investigating their super balances and questioning how they can protect their hard-earned money from further loss.

Here at DDP, we have had a surge of enquiries through our partner financial planners regarding purchasing property in Self-Managed-Super-Funds (SMSF’s).

Here are 3 frequently asked questions*:

1. Why invest your super in property?

If we examine the last 50 years of the Australian property market, we have seen property prices grow steadily over the long term. A property purchased 35 years ago in Sydney for $110,000, now has an estimated value of $1.8 million.

2. The power of capital appreciation

Investing your super in property allows you to use leverage / debt to invest. Your capital growth occurs on the property loan amount, not the amount you used from your superannuation balance, thus accelerating your wealth creation in the long term.

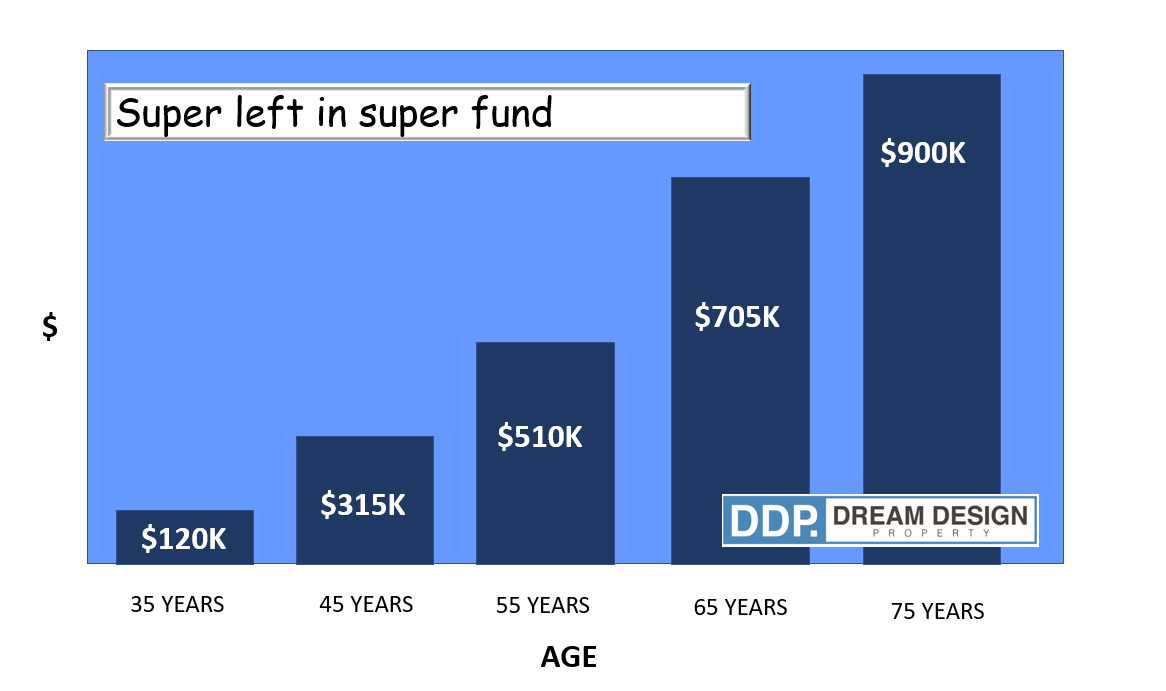

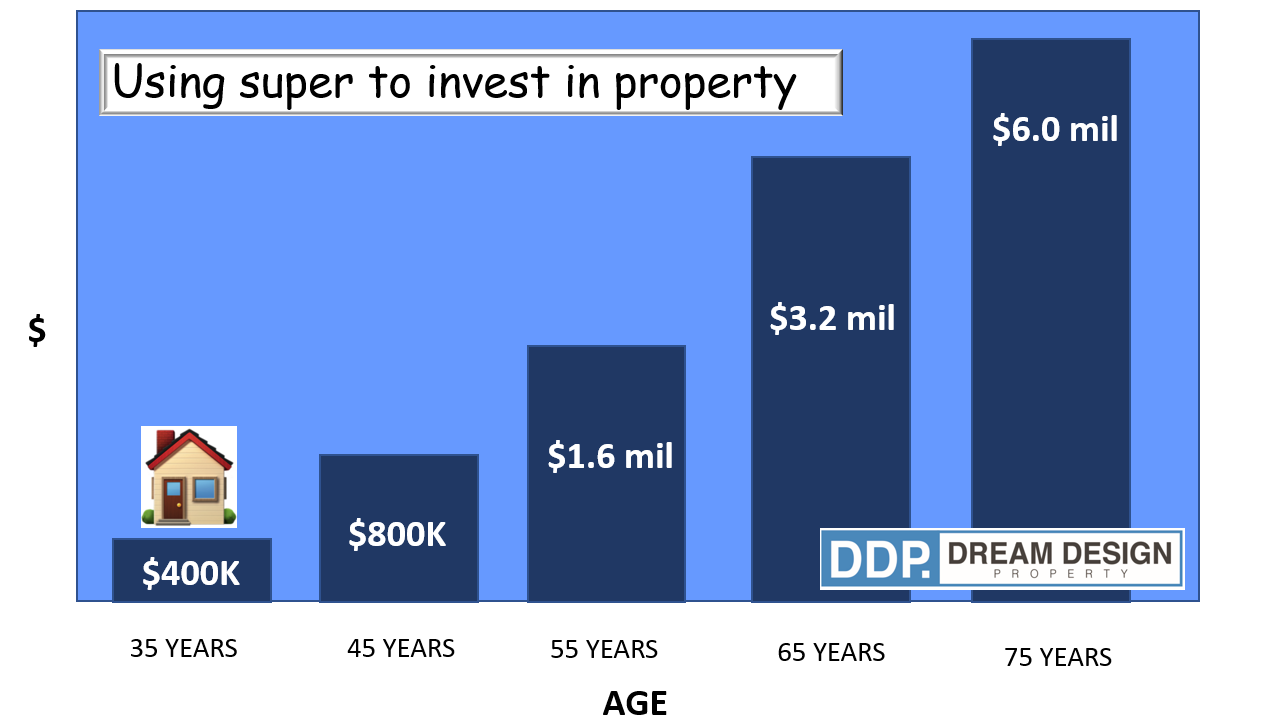

3. Case study: Superannuation Fund vs. Property In SMSF*

The reason for the dramatic difference between the 2 scenarios is due to capital growth in property value.

In scenario 2, the person is borrowing 80% of the property value of the purchase price (i.e. $400K). Thus, his capital appreciation is on the $400K as opposed to appreciation on the $120K in scenario 1.

DDP along with its partner financial planners and accountants have helped hundreds of people successfully buy property using their super.

Book your complimentary appointment with our Founder and partner financial planners to get your super working for you!