Queensland is showing strong signs of growth. More and more media articles and reports are surfacing predicting huge growth for this region.

Yesterday ANZ Bank crushed fears of a housing crash by changing its outlook, tipping a surge in Brisbane house prices next year. Economists at ANZ are now predicting gains of about 9.5 per cent in 2021.

(Source: The Courier Mail, 17th Nov 2020)

HERE’S OUR TOP PICK FOR YOU

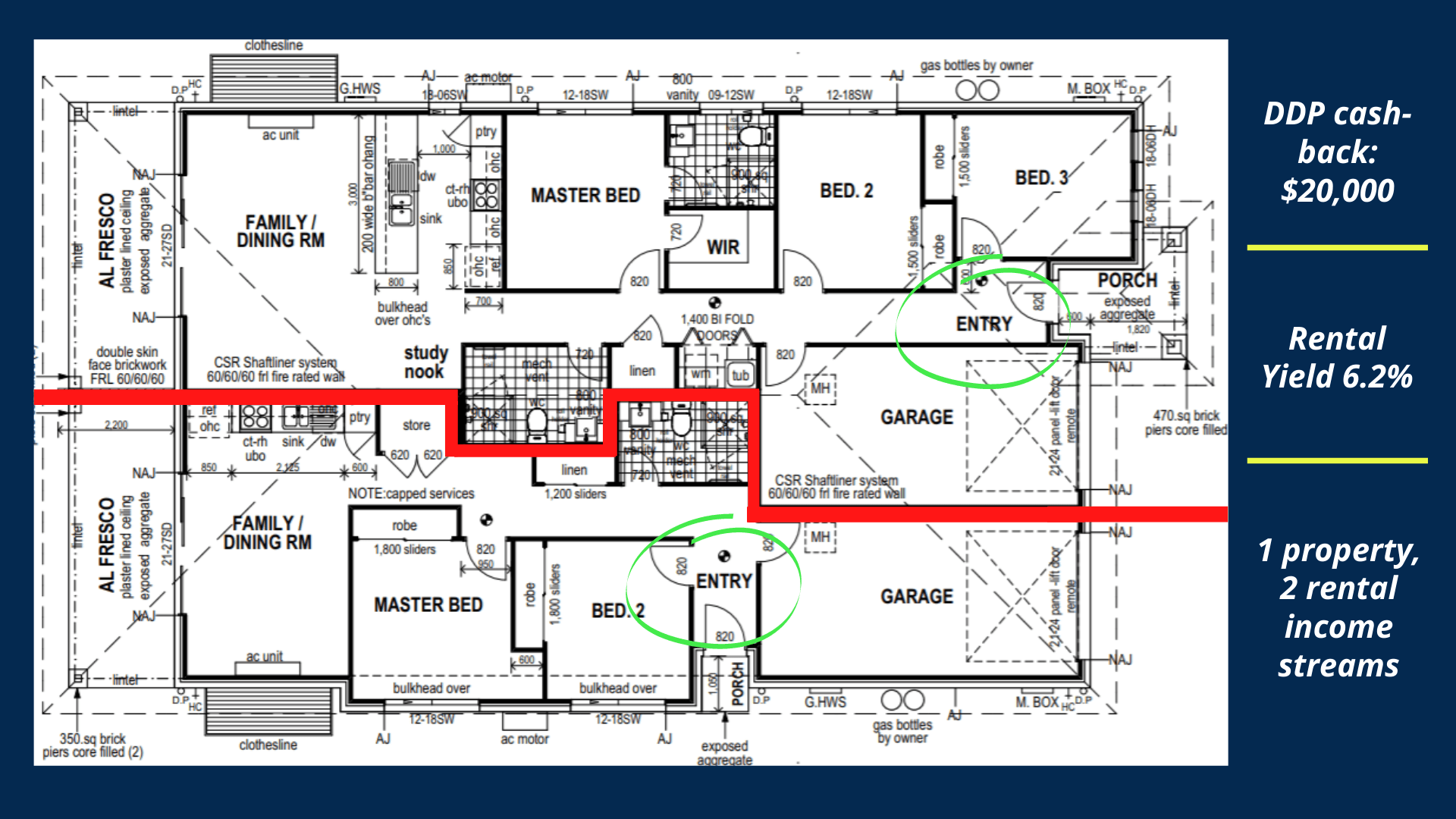

This dual occupancy, dual income property is set on a large land lot of 600m2.

- Purchase price: $590,000

- Get a DDP cash-back of $20,000

- Build completion: end of November 2020

- 1 property, 2 rental income streams

- Appraised rental return: $700 per week.

- Rental yield: 6.2%

Central to the M1 (Brisbane/Gold Coast) and the Ipswich Motorway, this property offers plenty of public transport including an express train to the city. Also located close to Logan Hospital, TAFE college and Griffith University and shopping centers.

DUAL KEY PROPERTY BENEFITS:

- 1 property, 2 rental income streams

- 2 sets of rent, 1 set of costs

- Can be owner occupied on one side, and rented from the second side

- Single strata title fees

- Higher rental yields

- Superior cash flow allowing the investor the opportunity to pay off their mortgage at a faster pace.