Setting up your SMSF (Self Managed Super Fund)

Disclaimer: Note DDP PROPERTY are not self-managed super fund advisors, and are NOT financial advisers. DDP will refer you to financial planners and accountants for you to have a consultation with to decide if a Self Managed Super Fund (SMSF) is suitable for you. Please obtain independent financial advice before you consider the set-up of a SMSF.

Superannuation is often an untapped resource. More awareness is surfacing around the benefits of buying investment property with super. In essence, how you manage your superannuation will determine your retirement lifestyle.

Unfortunately, Australians typically disregard their superannuation, not realising that it will either be their largest or second-largest (own-home) lifetime security.

As finance guru Robert Kiyosaki says: “Always remember that your future is determined by what you do today, not tomorrow.”

Set Up Costs Come from Your Super Fund, NOT Your Personal Savings

At first, most of our clients shy away from using their self-managed super fund for buying property until one of our SMSF accountants in Sydney, Melbourne or Brisbane runs through their SMSF investment options. They’ll detail the benefits and explain how all fees related to buying property with their SMSF are taken from their existing super balance, meaning NO OUT OF POCKET EXPENSES, keeping your personal savings out of it to get started.

The SMSF (Self-Managed Super Fund) set up cost and the DDP service fee is taken directly from your super.

CASE STUDY: Superannuation Fund vs. SMSF

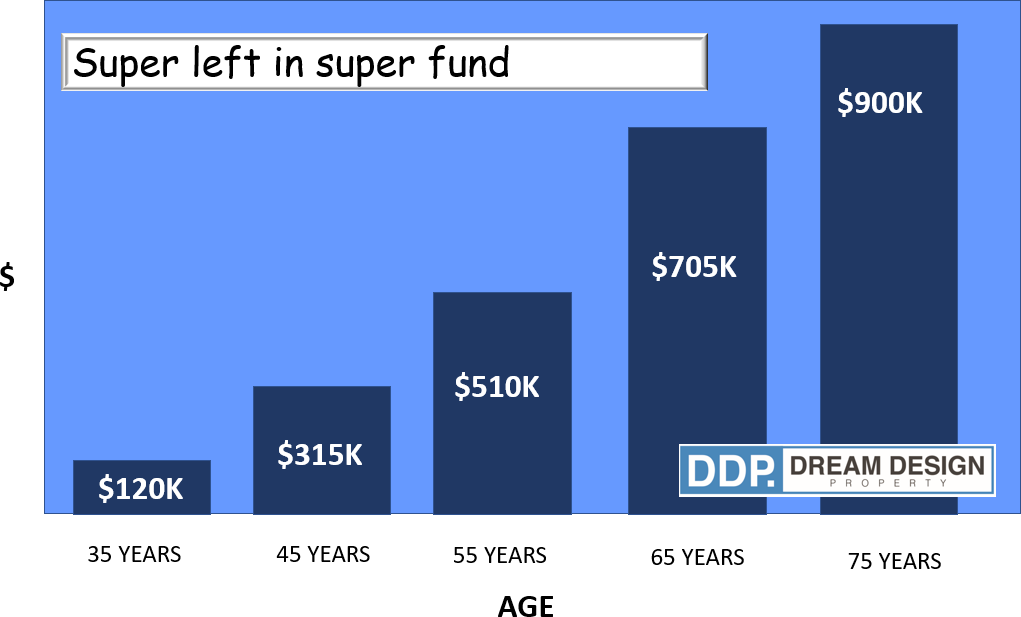

Scenario 1 – A man, aged 35 with a super balance of $120K, leaves his superannuation in his super fund and it continues to grow at a rate of 5% per year. At retirement, he is left with $900K*

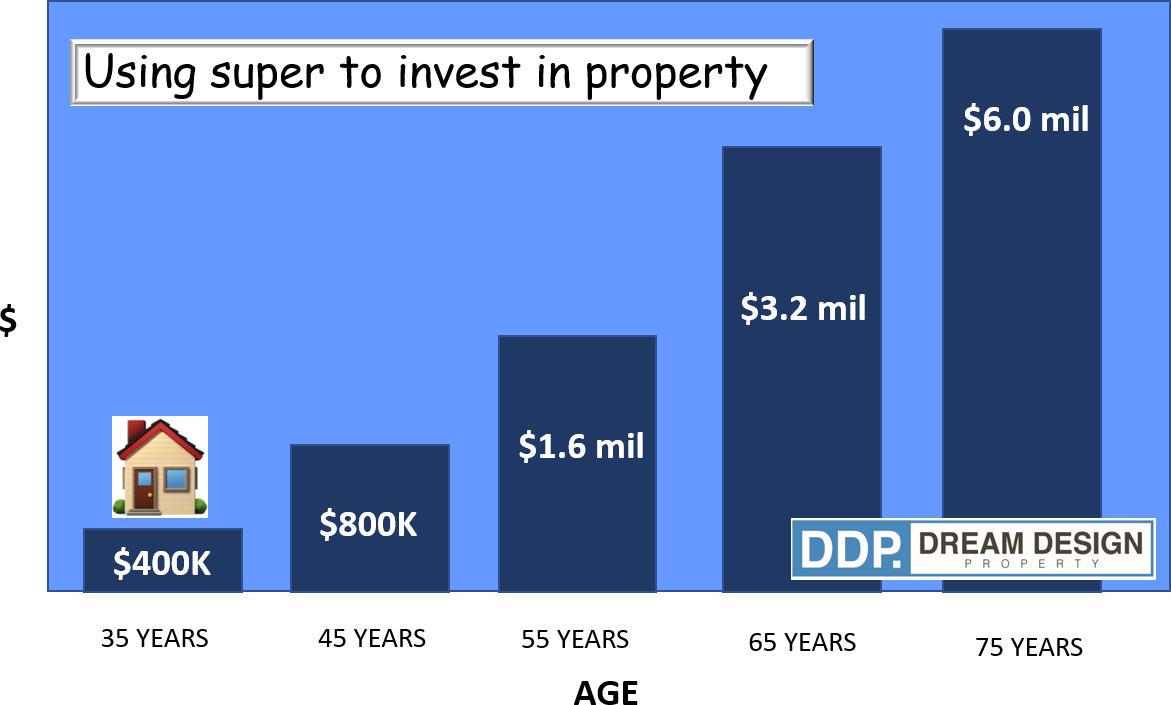

Scenario 2 – The same man uses his super to purchase a property in Sydney for a purchase price of $400K. He buys the superannuation investment property at the age of 35 by following a SMSF investment strategy. At retirement, his SMSF property investment is valued at $6.0million*

The reason for the dramatic difference between the 2 scenarios is due to the capital increase. The capital increase is measured by the difference between the current market value of a self-managed super fund property investment (i.e. at retirement) and its purchase price.

In scenario 2, the person is borrowing 80% of the self-managed super fund property value of the purchase price (i.e. $400K). Thus, his capital appreciation is on the $400K as opposed to appreciation on the $120K in scenario 1.

DDP Property has trusted SMSF advisers in Melbourne, Sydney and Brisbane who work closely with Financial Planners Australia wide who are regulated by ASIC to set up your SMSF property finance.

What is Included in the Self-Managed Super Fund (SMSF) Set-Up Fee?

To establish the self-managed super fund investment strategy, the financial planners will:

- Create the Corporate Trustee Constitution (legal documents) for the SMSF

- Register the Corporate Trustee with ASIC (including the ASIC fee)

- Create the SMSF Deed (legal documents)

- Australian Taxation Office (ATO) Registration of the SMSF TFN & ABN Generation with the ATO

- Bank Account Establishment with Macquarie Bank

- Transferring of Funds ($) from current Super Funds

- Advise you on how to make employer contributions into the SMSF

- Advise on the insurance transfer from industry/retail fund to SMSF & implementation

- Cancellation of old insurance policies if required

To establish the Property Trust for the SMSF property purchase, the financial planners and our SMSF auditors in Melbourne, Sydney or Brisbane will:

- Create the Corporate Trustee Constitution (legal documents) for the Property Trust

- Register the Corporate Trustee with ASIC (including the ASIC fee)

- Create the Property Trust Deed (legal documents)

- Provide the lending bank with a Financial Advisor sign off to authorise the loan

What Are the Costs to Set Up a Self-Managed Super Fund (SMSF)?

The total cost is dependent on the SMSF setup required.

Other inclusions

Financial Planners Advice & recommendations for transferring or leaving existing insurance policies. All accounting and financial advice costs plus the legal cost for documents (deed & constitution) plus ASIC & ATO registration fees.

Other Benefits of SMSF

Tax benefits– A super fund’s tax rate is 15%. This means if your self-managed super fund property investment has a net positive cash flow of $20,000 per year, inside a SMSF you would only pay $3,000 in tax. If it was purchased in your own name, it would depend on your marginal tax rate; however, your average tax would be anywhere between $7,000 and $9,000.*

Combining super with friends/family – You can combine your superannuation balance with other people – this can be with friends and family*. This works particularly well when your super balance is too low to buy a property on your own.

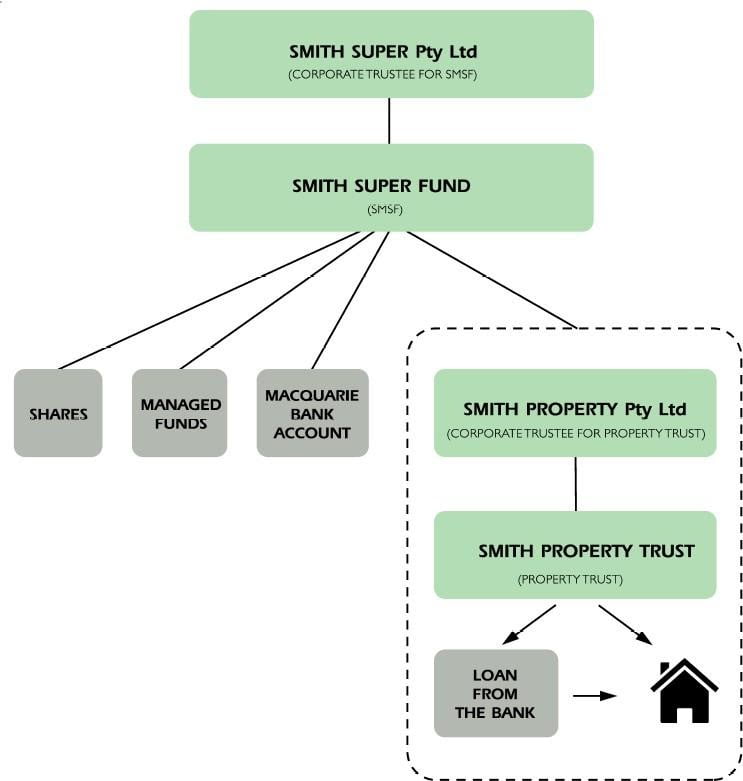

SMSF structure:

The SMSF diagram (BELOW) shows the 4 entities that are established for a client. It shows the Property & Loan being held within the Property Trust, and the Bank Account, Shares and Managed Funds being owned directly by the SMSF.

*Disclaimer: The information provided on this document has been provided as general advice only. We have not considered your financial circumstances, needs or objectives and you should seek the assistance of your FINANCIAL ADVISER before you make any decision regarding any products mentioned in this communication. Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither DDP PROPERTY nor its related entities, employees or agents shall be liable on any ground whatsoever with respect to decisions or actions taken as a result of you acting upon such information. For more information visit www.ddpproperty.com.au/disclaimer

Why Choose Us?

DDP Property has qualified SMSF accountants in Melbourne, Brisbane and Sydney who can guide you through various types of self-managed super fund investment options. They can also detail the SMSF loans that are available and advise you on which SMSF investment strategy to follow. We provide tailored SMSF advice to Brisbane, Sydney and Melbourne clients, and can help you track the progress of your SMSF property investment to ensure that you achieve your goals.

Contact Us Today

Are you thinking about purchasing a SMSF property in Brisbane, Sydney or Melbourne? Get in touch with our SMSF accountants in Brisbane, Melbourne or Sydney today by calling 1300 732 921 or submitting an online enquiry.